Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.

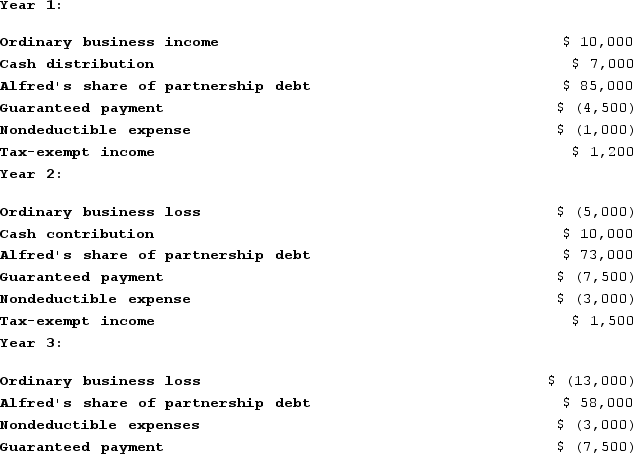

Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3.

Definitions:

Stinging Hair Cells

Specialized cells found in certain plants and animals used for defense or predation that deliver a sting or irritation when touched.

Portuguese Man-of-War

A marine cnidarian species known for its painful sting, characterized by its floating, gas-filled bladder and long tentacles.

Hydrozoans

Members of a class of predominantly marine animals in the phylum Cnidaria, which includes the Portuguese man-of-war, certain jellyfish, and hydra.

Ctenophores

A phylum of marine animals known as comb jellies, characterized by their gelatinous bodies and rows of ciliary plates for movement.

Q4: Horizontal equity is defined in terms of

Q12: Doris owns a one-third capital and profits

Q18: Frank and Bob are equal members in

Q24: Determine if eachof the following is a

Q33: Operating distributions completely terminate a partner's interest

Q35: Locke is a 50percent partner in the

Q78: Nadine Fimple is a one-third partner in

Q90: Beaver Company reports current E&P of $100,000

Q99: Keegan incorporated his sole proprietorship by transferring

Q129: Vanessa is the sole shareholder of V