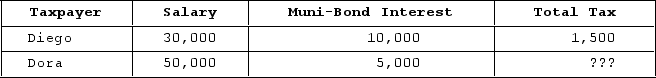

Given the following tax structure, what is the minimum tax that would need to be assessed on Dora to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Dora to make the tax progressive with respect to effective tax rates?

Definitions:

Perfect Information

A hypothetical market condition in which all participants have access to all relevant information to make fully informed decisions.

Public Goods

Goods that are non-excludable and non-rivalrous, making it difficult to restrict access to their benefits only to those who pay for them.

Collectively Consumed

Products or services that are used or consumed by a group of people simultaneously, such as public goods.

Exclude

To deliberately leave something or someone out of a group, list, or conversation.

Q12: A taxpayer's average tax rate is the

Q13: Viking Corporation is owned equally by Sven

Q14: Roy transfers property with a tax basis

Q20: Tyson is a 25percent partner in the

Q21: During 2020, CDE Corporation (an S corporation

Q56: Excise taxes are typically levied on the

Q70: During 2020, CDE Corporation (an S corporation

Q79: ABC was formed as a calendar-year S

Q115: Which of the following statements best describes

Q122: At the beginning of the year, Harold,