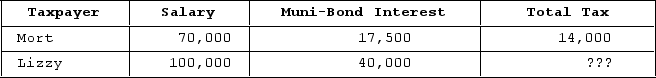

Given the following tax structure, what is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to be assessed on Lizzy to make the tax progressive with respect to effective tax rates?

Definitions:

Indicator Variable

A binary variable that takes the value 1 to indicate the presence of a particular feature or condition and 0 to indicate its absence.

Odds Ratio

A measure of association between an exposure and an outcome, indicating the odds of an outcome occurring in the presence compared to the absence of the exposure.

Logistic Regression Model

A statistical model that estimates the probability of a binary outcome based on one or more predictor variables.

Logistic Regression Model

A statistical model used to predict a binary outcome (such as yes/no, success/failure) based on one or more predictor variables.

Q17: At the end of Year 1, Tony

Q28: Assume that Clampett, Incorporated, has $200,000 of

Q29: Diego owns 30 percent of Azul Corporation.

Q40: Partnership tax rules incorporate both the entity

Q58: In 2020 Webtel Corporation donated $55,500 to

Q62: A partner that receives cash in an

Q94: An additional allocation of partnership debt or

Q101: Clampett, Incorporated, has been an S corporation

Q114: Partners must generally treat the value of

Q124: Sue and Andrew form SA general partnership.