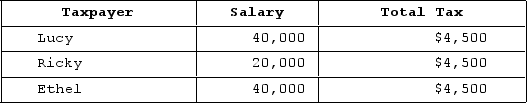

Consider the following tax rate structures. Is it horizontally equitable? Why or why not? Is it vertically equitable? Why or why not?

Definitions:

Disposable Income

Income that is available to households after paying taxes and receiving government transfers, used for spending or saving.

C

In the context of economic models, often stands for Consumption, which is a component of the GDP formula representing total spending by consumers on goods and services.

Gross Investment

The total amount spent on purchases of new capital assets and replacement of depreciated assets, not adjusted for depreciation.

Depreciation

Depreciation refers to the accounting method of allocating the cost of a tangible asset over its useful life, representing how much of an asset's value has been used up over time.

Q6: Leonardo, who is married but files separately,

Q26: Corporations may carry a net operating loss

Q27: Which of the following describes the correct

Q43: Geronimo files his tax return as a

Q76: Parker is a 100percent shareholder of Johnson

Q77: As part of its uncertain tax position

Q108: Bruin Company received a $100,000 insurance payment

Q112: The concept of tax sufficiency:<br>A)suggests the need

Q113: Corporations may carry excess charitable contributions forward

Q130: Which of the following statements regarding capital