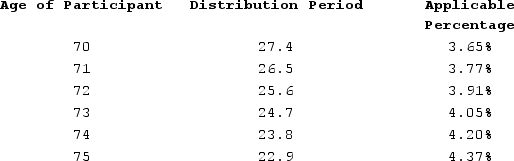

Sean (age 74 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,700,000 and the balance in his account on December 31, 2020, was $1,800,000. Using the Treasury tables below, what is Sean's required minimum distribution for 2020?

Definitions:

Credit Terms

Statements of the credit period and any discounts offered—for example, 2/10, net 30.

Discount Period

The time interval between when a bill of exchange is issued and its payment date, during which the bill is sold at a discount from face value.

2/10, Net 30

A common credit term indicating that a buyer can take a 2% discount on the invoice price if payment is made within 10 days, otherwise, the full invoice amount is due in 30 days.

Accruals

Adjustments in accounting for income that has been generated but not yet documented, and for costs that have been accrued but not yet documented.

Q7: Remsco has taxable income of $74,000 and

Q35: Employers receive a deduction for compensation paid

Q41: For compensation plans adopted by a publicly

Q52: Which is not one of the major

Q73: With regard to great management, treating everyone

Q74: Which of the following best describes distributions

Q76: Moody Corporation recorded the following deferred tax

Q93: In terms of allocating expenses between rental

Q101: Stevie recently received 1,000 shares of restricted

Q113: Yellow Rose Corporation reported pretax book income