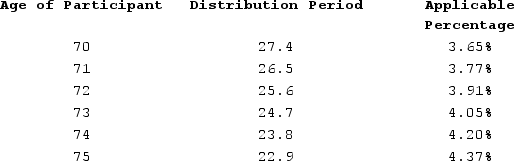

Sean (age 74 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,700,000 and the balance in his account on December 31, 2020, was $1,750,000. In 2020, Sean received a distribution of $50,000 from his 401(k)account. Assuming Sean's marginal tax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the Treasury table below in determining therequired minimum distribution penalty, if any).

Definitions:

Production Of Socks

The manufacturing process of creating socks, involving various steps from the sourcing of materials to the final product packaging.

Production Possibilities Frontier

A graphical representation showing the maximum combinations of goods and/or services that can be produced with a fixed set of resources.

Opportunity Cost

The lost benefit that could have been enjoyed if the chosen option had not been taken, implying the trade-off of forgoing the next best alternative.

Efficient Production Process

A method of production that uses the least amount of resources to achieve the maximum output.

Q4: Taxpayers who participate in an employer-sponsored retirement

Q28: The sale of computer equipment used in

Q46: Alexandra sold equipment that she uses in

Q75: Assume that Brittany acquires a competitor's assets

Q83: Leesburg sold a machine for $2,200 on

Q85: In 2020, Aspen Corporation reported $120,000 of

Q92: Identify the following items as creating a

Q93: Tyson (48 years old)owns a traditional IRA

Q104: An employee can indicate whether they want

Q105: Beth's business purchased only one asset during