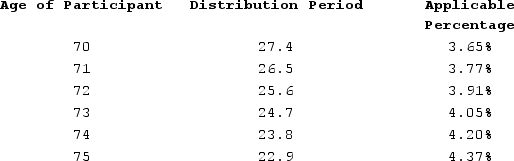

Sean (age 74 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,700,000 and the balance in his account on December 31, 2020, was $1,800,000. Using the Treasury tables below, what is Sean's required minimum distribution for 2020?

Definitions:

Human Personality

The combination of characteristics or qualities that form an individual's distinctive character, influencing behavior, thoughts, and emotions.

Conflict

A situation or process where differing needs, desires, or interests result in tension or dispute.

Impulse

An impulse is a sudden, involuntary urge to act or respond quickly without deliberate thought, often in response to a stimulus.

Geriatric Patients

Elderly individuals, often over the age of 65, who may require specialized healthcare due to aging-specific conditions.

Q13: Cardinal Corporation reported pretax book income of

Q40: Aiko (single, age 29)earned $40,000 in 2020.

Q41: Sumner sold equipment that it uses in

Q44: Gainesville LLC sold the following business assets

Q54: If a C corporation incurs a net

Q68: For 2020, up to $300 of transportation

Q88: Racine started a new business in the

Q92: Jane is an employee of Rohrs Golf

Q131: Kathy is 48 years of age and

Q135: Ryan, age 48, received an $8,000 distribution