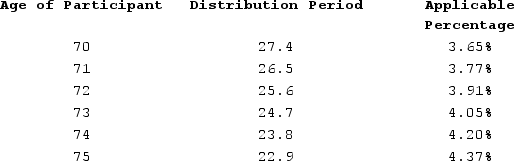

Sean (age 74 at end of 2020)retired five years ago. The balance in his 401(k)account on December 31, 2019, was $1,700,000 and the balance in his account on December 31, 2020, was $1,750,000. In 2020, Sean received a distribution of $50,000 from his 401(k)account. Assuming Sean's marginal tax rate is 25 percent, what amount of the $50,000 distribution will Sean have left after paying income tax on the distribution and paying any minimum distribution penalties (use the Treasury table below in determining therequired minimum distribution penalty, if any).

Definitions:

Emotionally Healthy Adults

Individuals who display mature emotional responses, have a strong sense of self, and can manage their emotions effectively.

Unconscious Forces

The underlying, hidden influences originating from the unconscious mind that affect thoughts, feelings, and behaviors.

Self-Objectification

The process by which individuals view themselves primarily as objects judged based on appearance, rather than based on abilities or personality.

Functionally Autonomous Motives

Refers to the idea that certain behaviors or motives can become independent from their original causes and continue to be pursued for their own sake.

Q1: Timothy purchased a new computer for his

Q10: As a negotiator, you would use a

Q23: Over what time period do corporations amortize

Q29: Which of the following statements regarding excess

Q34: Kathy is 48 years of age and

Q58: Jessie sold a piece of land held

Q77: Hazel received 22 NQOs (each option gives

Q101: Which of the following statements is false

Q106: When determining the number of days a

Q137: During 2020, Jacob, a 19-year-old full-time student,