TABLE 9-1

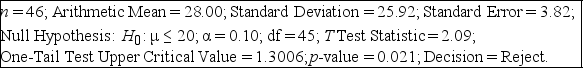

Microsoft Excel was used on a set of data involving the number of defective items found in a random sample of 46 cases of light bulbs produced during a morning shift at a plant. A manager wants to know if the mean number of defective bulbs per case is greater than 20 during the morning shift. She will make her decision using a test with a level of significance of 0.10. The following information was extracted from the Microsoft Excel output for the sample of 46 cases:

-Referring to Table 9-1, the manager can conclude that there is sufficient evidence to show that the mean number of defective bulbs per case is greater than 20 during the morning shift with no more than a 5% probability of incorrectly rejecting the true null hypothesis.

Definitions:

Variable Costing

An accounting method that includes only variable production costs (materials, labor, and overhead) in product costs and treats fixed costs as period expenses.

Profit Reported

The financial gain disclosed by a business, typically over a specific period, after all expenses have been deducted from total revenues.

Production and Sales

The activities involved in manufacturing goods and then selling them to customers, reflecting the entire flow from production to revenue generation.

Variable Costing

An accounting method that only considers variable costs (costs that fluctuate with the level of output) in calculating the cost of goods sold and in decision-making.

Q7: The Wall Street Journal recently ran an

Q31: If the amount of gasoline purchased per

Q42: Coverage error can become an ethical issue

Q48: In inferential statistics,the standard error of the

Q62: Referring to Table 8-6,this interval requires the

Q65: Referring to Table 9-4,if the level of

Q81: Referring to Table 8-14,what is the needed

Q118: Referring to Table 8-8,the parameter of interest

Q155: Which of the following sampling methods will

Q162: Referring to Table 11-2,the null hypothesis for