Use the following to answer the questions below.

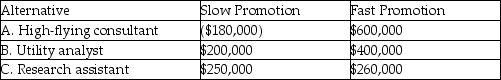

In choosing between three new jobs, Joe MBA considers the potential payoffs over the next three years. The following table contains the payoffs, given the speed of promotion in each of the organizations. The probability of fast promotion is 0.6, and the probability of slow promotion is 0.4.

-Use the information in Table A.3 and the expected-value rule. Which statement is True?

Definitions:

Cost of Goods Sold

The immediate expenses incurred in the production of a company's sold goods, encompassing materials, labor, and overhead costs.

Operating Expenses

Expenses incurred during regular business operations, such as rent, utilities, and salaries, but excluding cost of goods sold.

Cash Payments

Outflow of cash as a result of transactions, such as paying expenses, purchasing assets, or repaying debt.

Free Cash Flow

The amount of cash generated by a company’s operations after accounting for capital expenditures, available for dividends, debt repayment, or reinvestment.

Q16: _ is the degree to which equipment,

Q16: Customers are serviced at a rate of

Q25: How could a fishbone chart be used

Q34: When considering the plan-do-study-act cycle for problem

Q58: The mean of the Poisson distribution is

Q75: _ is a technique for systematically changing

Q76: In the context of operations scheduling, total

Q114: Quality at the source refers to the

Q142: An effective tool for showing steps of

Q194: Thermostats are subjected to rigorous testing before