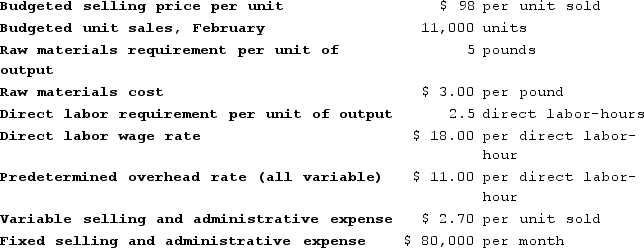

Murie Corporation makes one product and has provided the following information:  The estimated net operating income (loss) for February is closest to:

The estimated net operating income (loss) for February is closest to:

Definitions:

Earned Income

Income derived from active participation in a business, including wages, salaries, tips, and other compensation.

Education Credit Deduction

A tax benefit that reduces the amount of income tax owed by individuals paying for higher education expenses.

Qualified Expenses

Costs recognized by the IRS for specific tax benefits, such as education-related expenses eligible for tax credits.

Dependent

An individual, usually a child or spouse, who relies on another person for more than half of his or her financial support and qualifies for potential tax benefits on the caregiver's tax return.

Q16: Neubert Corporation manufactures and sells a single

Q37: Brockney Incorporated bases its manufacturing overhead budget

Q120: Bracken Clinic uses client-visits as its measure

Q147: Grohs Kennel uses tenant-days as its measure

Q154: Bramble Corporation is a small wholesaler of

Q179: Roediger Corporation is conducting a time-driven activity-based

Q220: Handal Corporation uses activity-based costing to compute

Q244: When activity-based costing is used for internal

Q351: Departmental overhead rates may not correctly assign

Q373: Roberds Tech is a for-profit vocational school.