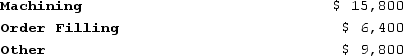

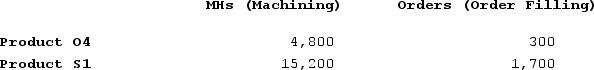

Handal Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

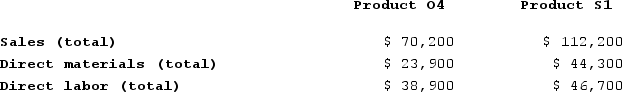

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins. What is the overhead cost assigned to Product S1 under activity-based costing?

What is the overhead cost assigned to Product S1 under activity-based costing?

Definitions:

Preference Shares

Shares which have rights to dividends that are paid out before dividends to common shareholders and may have priority over common shares in the event of liquidation.

Goodwill

Represents the excess amount paid over the fair market value of the net assets during an acquisition, attributed to factors like brand reputation, customer relations, and intellectual property.

Acquisition Differential

The difference between the cost of acquiring a company and the fair value of its identifiable net assets at the time of acquisition, essentially another term for goodwill.

Trademarks

Symbols, names, phrases, or logos legally registered or established by use as representing a company or product.

Q1: Hagy Corporation has an activity-based costing system

Q95: KAB Incorporated, a small retail store, had

Q112: A manufacturing company that produces a single

Q138: Wolanski Corporation has provided the following data

Q208: Reck Corporation uses activity-based costing to assign

Q228: Oltz Corporation is conducting a time-driven activity-based

Q270: Carlton Corporation has two divisions: Delta and

Q287: Nissley Wedding Fantasy Corporation makes very elaborate

Q322: Leaper Corporation uses an activity-based costing system

Q371: Jemmott Corporation has two divisions: Western Division