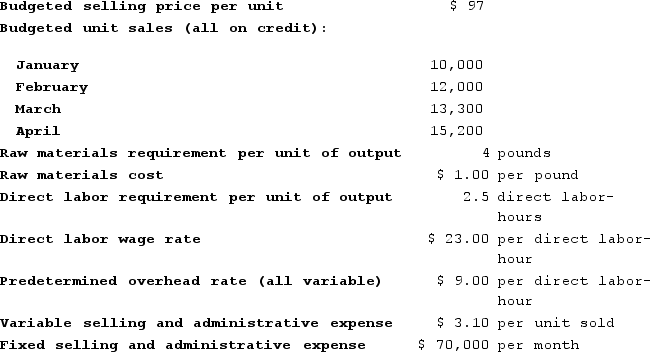

Bonkowski Corporation makes one product and has provided the following information to help prepare the master budget for the next four months of operations:  Credit sales are collected:30% in the month of the sale70% in the following monthRaw materials purchases are paid:30% in the month of purchase70% in the following monthThe ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.The estimated direct labor cost for February is closest to:

Credit sales are collected:30% in the month of the sale70% in the following monthRaw materials purchases are paid:30% in the month of purchase70% in the following monthThe ending finished goods inventory should equal 30% of the following month's sales. The ending raw materials inventory should equal 10% of the following month's raw materials production needs.The estimated direct labor cost for February is closest to:

Definitions:

Maintenance

Activities and practices aimed at keeping equipment, systems, and facilities in optimal working condition, as well as preserving the well-being and performance of employees.

Pre-Tax Income

The amount of income earned by a business or individual before any taxes have been deducted.

Publicly Traded

Refers to a company whose shares are available for purchase by the public on stock exchanges.

Tax Burden

The total amount of taxes paid by an individual or business, expressed as a percentage of income.

Q36: Luckman Corporation bases its budgets on the

Q102: Bramble Corporation is a small wholesaler of

Q138: Cardle Corporation makes one product. Budgeted unit

Q197: Masde Corporation produces and sells Product CharlieD.

Q249: Hagy Corporation has an activity-based costing system

Q293: In time-based activity-based costing, the practical capacity

Q300: Lopresto Corporation is conducting a time-driven activity-based

Q301: Huelskamp Corporation has provided the following data

Q452: Harold Corporation manufactures and sells a single

Q484: Paulis Kennel uses tenant-days as its measure