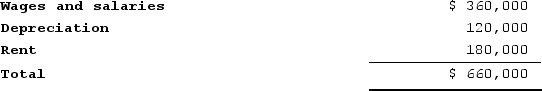

Huelskamp Corporation has provided the following data concerning its overhead costs for the coming year:  The company has an activity-based costing system with the following three activity cost pools and estimated activity for the coming year:

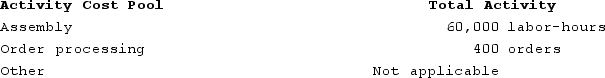

The company has an activity-based costing system with the following three activity cost pools and estimated activity for the coming year: The Other activity cost pool does not have a measure of activity; it is used to accumulate costs of idle capacity and organization-sustaining costs.The distribution of resource consumption across activity cost pools is given below:

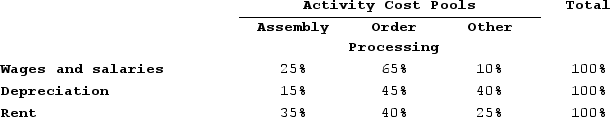

The Other activity cost pool does not have a measure of activity; it is used to accumulate costs of idle capacity and organization-sustaining costs.The distribution of resource consumption across activity cost pools is given below: The activity rate for the Assembly activity cost pool is closest to:

The activity rate for the Assembly activity cost pool is closest to:

Definitions:

Incremental Borrowing Rate

The interest rate a company would have to pay if it borrows funds, a critical component in lease accounting.

Balance Sheet

A financial statement that provides a snapshot of a company’s financial position at a specific point in time, showing assets, liabilities, and shareholder equity.

Liability

A financial obligation or debt owed by a company to others, often categorized as current or long-term.

Incremental Borrowing Rate

The interest rate a company would have to pay if it borrows funds, serving as an estimate for lease accounting when the implicit rate in the lease is unclear.

Q36: Luckman Corporation bases its budgets on the

Q48: Sevenbergen Corporation makes one product and has

Q98: Carver Lumber sells lumber and general building

Q125: Lindenmuth Corporation is conducting a time-driven activity-based

Q148: Sthilaire Corporation is working on its direct

Q172: Laizure Clinic uses patient-visits as its measure

Q198: Haylock Incorporated bases its manufacturing overhead budget

Q285: In the second-stage allocation in activity-based costing,

Q324: Fleisher Corporation is conducting a time-driven activity-based

Q379: Angara Corporation uses activity-based costing to determine