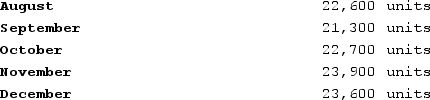

Caspion Corporation makes and sells a product called a Miniwarp. One Miniwarp requires 2.5 kilograms of the raw material Jurislon. Budgeted production of Miniwarps for the next five months is as follows:  The company wants to maintain monthly ending inventories of Jurislon equal to 20% of the following month's production needs. On July 31, this requirement was not met since only 10,800 kilograms of Jurislon were on hand. The cost of Jurislon is $18.00 per kilogram. The company wants to prepare a Direct Materials Purchase Budget for the next five months.The total cost of Jurislon to be purchased in August is:

The company wants to maintain monthly ending inventories of Jurislon equal to 20% of the following month's production needs. On July 31, this requirement was not met since only 10,800 kilograms of Jurislon were on hand. The cost of Jurislon is $18.00 per kilogram. The company wants to prepare a Direct Materials Purchase Budget for the next five months.The total cost of Jurislon to be purchased in August is:

Definitions:

Turnover

The total revenues or sales achieved by a company in a specified period, or the rate at which inventory is sold and replaced.

Average Operating Assets

A metric calculated as the average value of the assets involved in generating operating income over a specific period.

Net Operating Income

A measure of a company's profitability from its regular business operations, excluding deductions of interest and taxes.

Gross Margin

The difference between revenue and cost of goods sold, used to cover other expenses and profits.

Q17: Wrench Corporation is conducting a time-driven activity-based

Q84: Ploof Corporation is conducting a time-driven activity-based

Q124: Bonkowski Corporation makes one product and has

Q181: Korsak Corporation is a service company that

Q191: Fletes Corporation manufactures two products: Product O95C

Q246: The budgeted income statement is typically prepared

Q264: Smith Corporation makes and sells a single

Q289: Doede Corporation uses activity-based costing to compute

Q423: Varriano Corporation bases its budgets on the

Q466: Lenci Corporation manufactures and sells a single