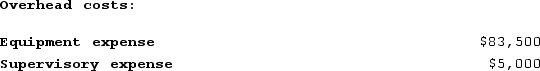

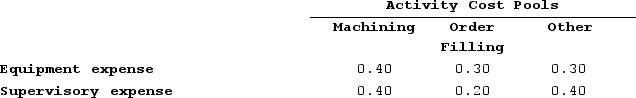

Meester Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

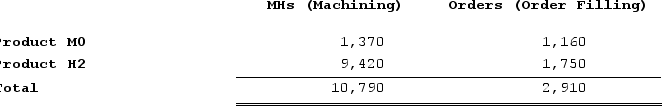

Distribution of Resource Consumption Across Activity Cost Pools: Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: What is the overhead cost assigned to Product H2 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

What is the overhead cost assigned to Product H2 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

Definitions:

Performance Effectiveness

A measure of how well an individual, system, or organization achieves its goals and objectives in a quality and timely manner.

Productivity

measures the efficiency of production of goods or services, often quantified as the ratio of output to input.

Major Responsibilities

The primary duties or tasks that an individual or a role within an organization is expected to perform as part of their job.

Q45: Mustafa Enterprises makes a variety of products

Q132: Wala Incorporated bases its selling and administrative

Q136: Higado Confectionery Corporation has a number of

Q220: Handal Corporation uses activity-based costing to compute

Q242: Cryan Jeep Tours operates jeep tours in

Q246: The budgeted income statement is typically prepared

Q253: In activity-based costing, as in traditional costing

Q258: Sevenbergen Corporation makes one product and has

Q376: Lysiak Corporation uses an activity based costing

Q380: Greife Corporation's activity-based costing system has three