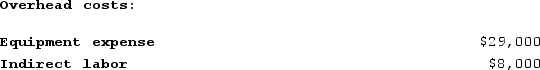

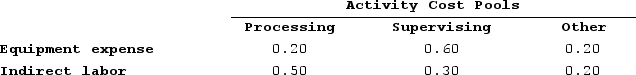

Bartow Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment expense and indirect labor--are allocated to the three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

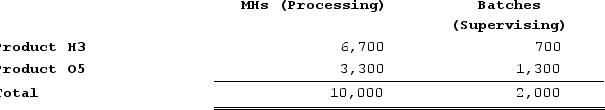

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: What is the overhead cost assigned to Product H3 under activity-based costing?

What is the overhead cost assigned to Product H3 under activity-based costing?

Definitions:

Main Section

The primary or central part of something, particularly in the context of a document, machine, or organization.

Multiplexing

A technique that enables multiple signals or data streams to be combined and transmitted over a single physical medium, improving efficiency in communication systems.

Synchronize

The process of making two or more processes, devices, or systems operate in unison by matching their speeds, frequencies, or timings.

Clutch

Device used to break torque flow between an engine and transmission and to apply/release application force in other units.

Q11: Data concerning three of the activity cost

Q109: Michard Corporation makes one product and it

Q197: Arrasmith Corporation uses customers served as its

Q211: The Puyer Corporation makes and sells only

Q268: There are various budgets within the master

Q276: Petrini Corporation makes one product and it

Q285: In the second-stage allocation in activity-based costing,

Q358: Smith Corporation is a shipping container refurbishment

Q387: Baughn Corporation, which has only one product,

Q428: Reef Slithering Riverboat Tours is a tour