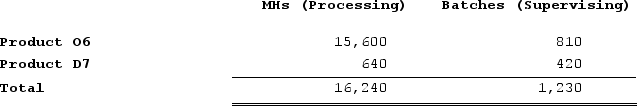

Wedd Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $51,000; Supervising, $31,600; and Other, $20,300. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Co-Insurance Clause

A provision in an insurance policy that requires the policyholder to bear a portion of the loss in return for a lower premium.

Insurance Claimed

Insurance claimed involves a request for payment based on the terms of an insurance policy, following a loss, damage, or occurrence covered by the policy.

Actual Value

The true or genuine value of an asset or property, based on factual evidence and market conditions.

Interest in a House

A financial or ownership stake in a property, including rights to use or benefit from the property which may include equity or debt interests.

Q6: Ruiz Clinic bases its budgets on the

Q56: Imbesi Corporation is conducting a time-driven activity-based

Q75: Weldon Corporation has provided the following data

Q99: Petrini Corporation makes one product and it

Q103: Mumbower Corporation makes one product and has

Q106: Wolanski Corporation has provided the following data

Q107: A manufacturing company that produces a single

Q279: Difabio Tech is a for-profit vocational school.

Q333: Handal Corporation uses activity-based costing to compute

Q379: Angara Corporation uses activity-based costing to determine