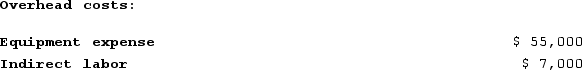

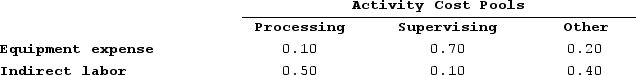

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

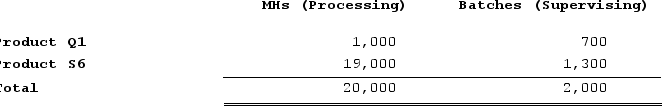

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

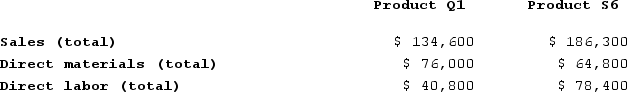

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data: How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

How much overhead cost is allocated to the Processing activity cost pool under activity-based costing in the first stage of allocation?

Definitions:

Q11: Rokosz Corporation makes one product and it

Q16: Hayworth Corporation has just segmented last year's

Q182: The Jung Corporation's production budget calls for

Q265: Coles Corporation, Incorporated makes and sells a

Q267: Petrini Corporation makes one product and it

Q297: Choi Corporation is conducting a time-driven activity-based

Q337: Nantor Corporation has two divisions, Southern and

Q348: Handal Corporation uses activity-based costing to compute

Q360: Under variable costing, all variable production costs

Q414: Morles Jeep Tours operates jeep tours in