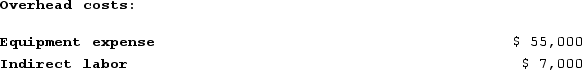

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

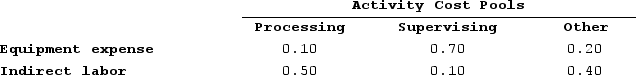

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

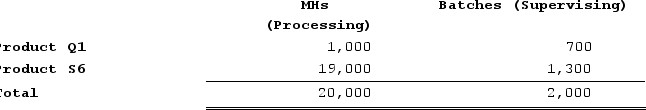

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data: What is the product margin for Product Q1 under activity-based costing?

What is the product margin for Product Q1 under activity-based costing?

Definitions:

Horizontal Communication

The exchange of information between individuals or groups at the same level within an organization.

Lateral

Referring to interactions or relationships that occur at the same level of hierarchy within an organization, as opposed to vertical, top-down relations.

Department Heads

Individuals responsible for overseeing specific departments within an organization, ensuring their team's performance aligns with company goals.

Communication Networks

A framework for how messages are transmitted and received within an organization, encompassing various modes and channels of communication.

Q26: Leber Enterprises makes a variety of products

Q85: Tat Corporation produces a single product and

Q116: Bennette Corporation has provided the following data

Q125: Otomo Jeep Tours operates jeep tours in

Q235: The budgeted variable selling and administrative expense

Q297: Choi Corporation is conducting a time-driven activity-based

Q332: The Southern Corporation manufactures a single product

Q344: Weimar Corporation is conducting a time-driven activity-based

Q348: Handal Corporation uses activity-based costing to compute

Q375: Howell Corporation's activity-based costing system has three