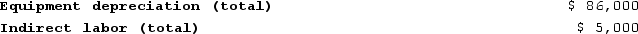

Howell Corporation's activity-based costing system has three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.

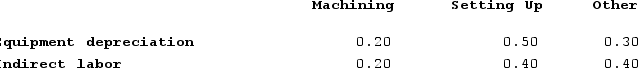

Distribution of Resource Consumption Across Activity Cost Pools

Distribution of Resource Consumption Across Activity Cost Pools

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

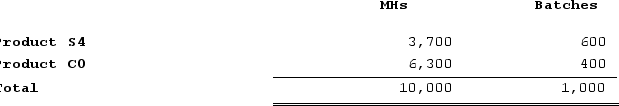

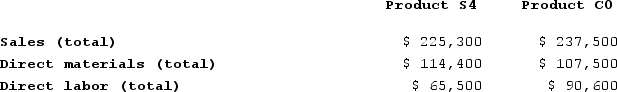

Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:

Required:a. Assign overhead costs to activity cost pools using activity-based costing.b. Calculate activity rates for each activity cost pool using activity-based costing.c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.d. Determine the product margins for each product using activity-based costing.

Required:a. Assign overhead costs to activity cost pools using activity-based costing.b. Calculate activity rates for each activity cost pool using activity-based costing.c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.d. Determine the product margins for each product using activity-based costing.

Definitions:

Predation

The preying of one animal on others, a biological interaction where a predator feeds on its prey.

Cichlids

A diverse family of freshwater fish known for their complex behaviors and varied colors and shapes.

Killifish

Small, colorful freshwater fish belonging to the family Cyprinodontiformes, known for their diverse habitats and as model organisms in scientific research.

Exponential Growth

A growth pattern in which the rate of growth is proportional to the current quantity, leading to faster and faster growth as time progresses.

Q2: Meli Corporation manufactures two products: Product L61P

Q45: Simila Corporation has provided the following data

Q92: Carver Lumber sells lumber and general building

Q105: Addleman Corporation has an activity-based costing system

Q108: Rovinsky Corporation, a company that produces and

Q125: Lindenmuth Corporation is conducting a time-driven activity-based

Q135: Azuki Corporation operates in two sales territories,

Q146: Krepps Corporation produces a single product. Last

Q304: Lindenmuth Corporation is conducting a time-driven activity-based

Q373: Segment margin is sales less variable expenses