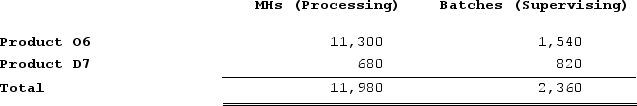

Wedd Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $49,800; Supervising, $27,500; and Other, $24,900. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  What is the overhead cost assigned to Product O6 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

What is the overhead cost assigned to Product O6 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

Definitions:

Business Trip

A journey taken for work or corporate purposes, excluding daily commutes, involving travel outside the normal work area.

Transfer Of Title

The legal process of transferring property ownership from one party to another.

Personal Property

Personal property refers to movable assets or belongings that are not fixed to one location, such as furniture, vehicles, and electronic equipment, in contrast to real property.

Deed

A legal document that represents the ownership of real estate or property, which is transferred from one party to another.

Q25: Baraban Corporation has provided the following data

Q47: Cieslinski Corporation is conducting a time-driven activity-based

Q49: Cumberland Enterprises makes a variety of products

Q72: Offerman Corporation is conducting a time-driven activity-based

Q128: A reason why absorption costing income statements

Q196: Larry Enterprises makes a variety of products

Q199: Leaper Corporation uses an activity-based costing system

Q241: Petrini Corporation makes one product and it

Q245: Weimar Corporation is conducting a time-driven activity-based

Q332: Torello Corporation manufactures two products: Product H95V