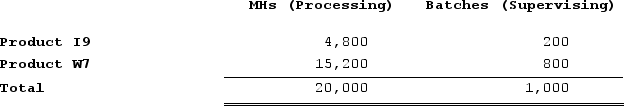

Sorice Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $20,200; Supervising, $11,000; and Other, $66,800. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  What is the overhead cost assigned to Product W7 under activity-based costing?

What is the overhead cost assigned to Product W7 under activity-based costing?

Definitions:

Mining Partnership

A specialized form of association where two or more persons collaborate in the development and operation of a mine, sharing profits and losses proportionally to their contributions.

Mineral Interest

The legal share or entitlement to profits from minerals extracted from the ground, typically pertaining to property rights in the context of real estate.

Purported Partners

Individuals who are claimed to be partners in a business, sometimes without the legal or actual basis for such a partnership.

Doctrine of Respondeat Superior

A legal principle that holds an employer or principal liable for the actions of an employee or agent when those actions occur within the scope of employment or authority.

Q35: Younie Corporation has two divisions: the South

Q52: Lamorte Corporation is conducting a time-driven activity-based

Q75: In the manufacturing overhead budget, the non-cash

Q112: A manufacturing company that produces a single

Q145: Danahy Corporation manufactures a single product. The

Q178: Krepps Corporation produces a single product. Last

Q223: Which of the following will usually be

Q233: On October 1, Gala Corporation has 300

Q253: Bertie Corporation has two divisions: Retail Division

Q277: A sales budget is given below for