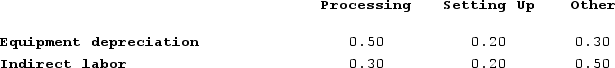

Moorman Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs consist of equipment depreciation and indirect labor and are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Equipment depreciation totals $62,000 and indirect labor totals $2,000. Data concerning the distribution of resource consumption across activity cost pools appear below:

Required:Assign overhead costs to activity cost pools using activity-based costing.

Required:Assign overhead costs to activity cost pools using activity-based costing.

Definitions:

Head of State

The chief public representative of a country, such as a president or monarch, who may also have various official duties but often symbolizes the unity and legitimacy of the state.

Executive Orders

Directives issued by the President of the United States to manage operations of the federal government; they have the force of law but do not require congressional approval.

Signing Statements

Written comments issued by a President when signing legislation, which may outline their interpretation of the law or comment on sections they find problematic.

Bureaucracy

A system of managing government through departments run by appointed officials, often characterized by specialization of functions and adherence to fixed rules.

Q67: Doede Corporation uses activity-based costing to compute

Q69: Super-variable costing is most appropriate where:<br>A) direct

Q96: Neelon Corporation has two divisions: Southern Division

Q119: Ledonne Corporation is conducting a time-driven activity-based

Q164: Homeyer Corporation has provided the following data

Q170: Nissley Wedding Fantasy Corporation makes very elaborate

Q179: Roediger Corporation is conducting a time-driven activity-based

Q264: Bachrodt Corporation uses activity-based costing to compute

Q275: Cieslinski Corporation is conducting a time-driven activity-based

Q317: Neef Corporation has provided the following data