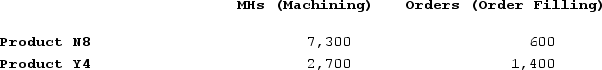

Dercole Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Machining, $43,200; Order Filling, $13,900; and Other, $14,900. Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  The activity rate for the Machining activity cost pool under activity-based costing is closest to:

The activity rate for the Machining activity cost pool under activity-based costing is closest to:

Definitions:

Molding Department

A specialized section within a manufacturing facility where the shaping or molding of materials into finished products occurs.

Conversion Costs

Expenses associated with transforming raw materials into complete goods, which encompass both direct labor and the costs of manufacturing overhead.

Weighted-Average Method

An inventory costing method that assigns a cost to inventory on the basis of the average cost of all similar items in the inventory.

Lubricating Department

A specialized division in a manufacturing or maintenance facility focused on the application of lubricants to machinery and equipment to reduce friction and wear.

Q16: Acti Manufacturing Corporation is estimating the following

Q97: Moorman Corporation has an activity-based costing system

Q105: Davis Corporation is preparing its Manufacturing Overhead

Q109: Aaron Corporation, which has only one product,

Q243: Ferrar Corporation has two major business segments:

Q265: Hollifield Corporation is conducting a time-driven activity-based

Q279: Tatman Corporation uses an activity-based costing system

Q301: Janos Corporation, which has only one product,

Q367: Mandato Corporation has provided the following data

Q376: Lysiak Corporation uses an activity based costing