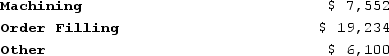

Handal Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Machining, Order Filling, and Other. The costs in those activity cost pools appear below:  Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

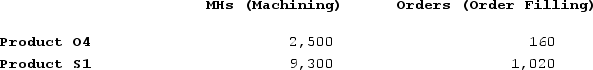

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.

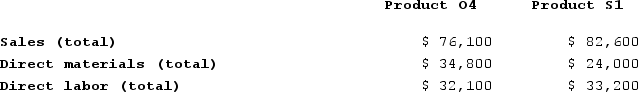

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins. What is the overhead cost assigned to Product S1 under activity-based costing? (Round the Intermediate calculation to two decimal places and your final answer to nearest whole dollar.)

What is the overhead cost assigned to Product S1 under activity-based costing? (Round the Intermediate calculation to two decimal places and your final answer to nearest whole dollar.)

Definitions:

Marginal Costs

The added expense to produce one more item; it can decrease or increase depending on production size and efficiency.

Marginal Benefits

The boost in satisfaction or usefulness derived from the consumption of an additional unit of a good or service.

Rational Individuals

People who make decisions by logically evaluating options based on their preferences and the likely outcomes to maximize their benefit or utility.

Production Possibilities Curve

A graphical representation that shows the maximum quantity of two products that can be produced within a given set of resources, highlighting the trade-offs and opportunity costs.

Q21: When sales exceed production and the company

Q53: Gendel Corporation is conducting a time-driven activity-based

Q60: Mosburg Corporation is conducting a time-driven activity-based

Q120: The Charade Corporation is preparing its Manufacturing

Q208: Reck Corporation uses activity-based costing to assign

Q239: Dilly Farm Supply is located in a

Q248: Campanaro Corporation is conducting a time-driven activity-based

Q252: Schackow Corporation is conducting a time-driven activity-based

Q264: Bachrodt Corporation uses activity-based costing to compute

Q339: Hadley Corporation, which has only one product,