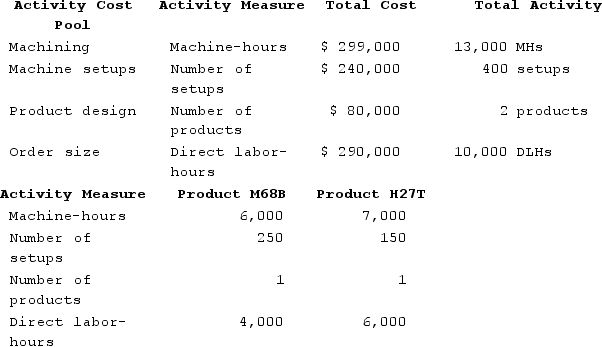

Horgen Corporation manufactures two products: Product M68B and Product H27T. The company is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products M68B and H27T.  Using the activity-based costing system, how much total manufacturing overhead cost would be assigned to Product H27T?

Using the activity-based costing system, how much total manufacturing overhead cost would be assigned to Product H27T?

Definitions:

Equity Method

An accounting technique used by firms to assess the profits earned from their investments in other companies, where the investment's value is adjusted in accordance with the investor's share of the investee's profits or losses.

No Excess Amortizations

Indicates there is no undue or excessive allocation of the cost of an intangible asset over its useful life.

Equity Method

An accounting technique used when an investing company holds significant influence over the investee, reflecting the share of the latter's profit and loss.

Noncontrolling Interest

An ownership interest in a corporation where the share does not grant the holder the majority of voting power, often reflected as a minority stake in subsidiary companies on consolidated financial statements.

Q53: Gendel Corporation is conducting a time-driven activity-based

Q79: Mirabile Corporation uses activity-based costing to compute

Q80: Fiwrt Corporation manufactures and sells stainless steel

Q99: Petrini Corporation makes one product and it

Q160: Petrini Corporation makes one product and it

Q230: Ferrar Corporation has two major business segments:

Q236: Combe Corporation has two divisions: Alpha and

Q256: Tat Corporation produces a single product and

Q337: Nantor Corporation has two divisions, Southern and

Q353: Columbia Corporation produces a single product. The