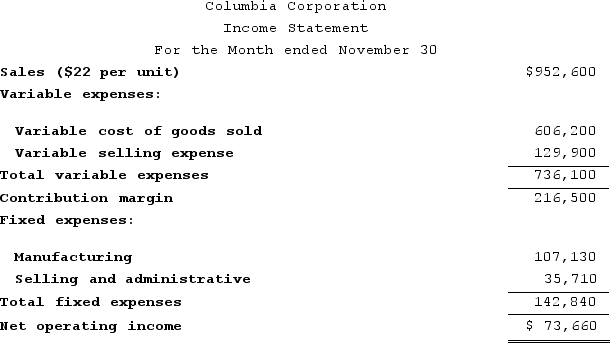

Columbia Corporation produces a single product. The company's variable costing income statement for November appears below:  During November, 35,710 units were manufactured and 8,490 units were in beginning inventory. Variable production costs per unit, total fixed manufacturing expenses, and the number of units produced were the same in prior months.Under absorption costing, for November the company would report a:

During November, 35,710 units were manufactured and 8,490 units were in beginning inventory. Variable production costs per unit, total fixed manufacturing expenses, and the number of units produced were the same in prior months.Under absorption costing, for November the company would report a:

Definitions:

Net Income

The remaining earnings of a company following the deduction of all expenses and taxes from its total income.

Deferred Revenue

Income received by a company for goods or services yet to be delivered or performed, recorded as a liability on the balance sheet.

Liability

A financial obligation or debt owed by a business or individual to others, which requires settlement in the future.

Asset

Resources owned or controlled by a business, expected to produce future economic benefits.

Q74: Which of the following statements is correct

Q82: Farris Corporation, which has only one product,

Q114: Eyestone Corporation has two divisions, A and

Q145: Danahy Corporation manufactures a single product. The

Q145: A company sells two products--J and K.

Q266: Clutts Corporation is conducting a time-driven activity-based

Q276: Cieslinski Corporation is conducting a time-driven activity-based

Q293: Kelchner Corporation has provided the following contribution

Q301: Huelskamp Corporation has provided the following data

Q355: Provenzano Corporation manufactures two products: Product B56Z