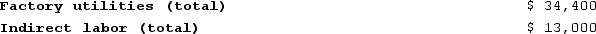

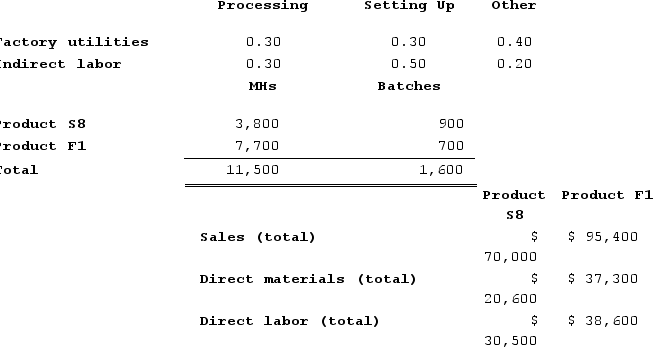

Groleau Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Costs in the Processing cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below:

Distribution of Resource Consumption Across Activity Cost Pools

Distribution of Resource Consumption Across Activity Cost Pools

Required:a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing.

Required:a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing.

Definitions:

Insufficient Strength

A lack of adequate power or capability to produce a desired effect or outcome.

Staged Manipulation

A research method where conditions are deliberately created or modified by the researcher to observe their effect on behavior.

Straightforward Manipulations

Direct, clear changes made to the independent variable without the use of deception or complicated procedures.

Psychological State

A person's current mental and emotional condition.

Q31: Weisgarber Corporation is conducting a time-driven activity-based

Q89: Millner Corporation has provided the following data

Q166: Caruso Incorporated, which produces a single product,

Q181: Jemmott Corporation has two divisions: Western Division

Q227: Dilly Farm Supply is located in a

Q230: Figge and Mathews PLC, a consulting firm,

Q239: Gutknecht Corporation uses an activity-based costing system

Q251: Immen Corporation manufactures two products: Product B82O

Q296: Meester Corporation has an activity-based costing system

Q372: Assuming the LIFO inventory flow assumption, when