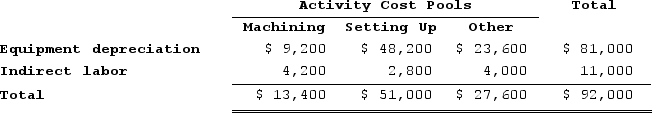

Musich Corporation has an activity-based costing system with three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, have been allocated to the cost pools already and are provided in the table below.

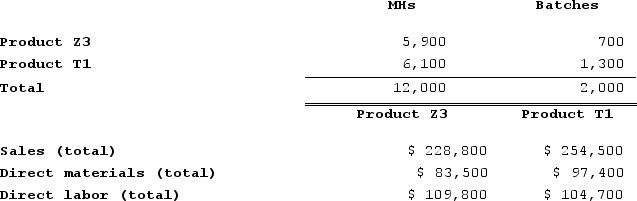

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:a. Calculate activity rates for each activity cost pool using activity-based costing. b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. c. Determine the product margins for each product using activity-based costing.

Required:a. Calculate activity rates for each activity cost pool using activity-based costing. b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. c. Determine the product margins for each product using activity-based costing.

Definitions:

Long-Term Memory

The phase of the memory process that is capable of storing information for extended periods, from days to a lifetime.

Richard Atkinson

A psychologist known for his contributions to the study of memory and cognition, including the development of the multi-store model of memory.

Web Address

The unique identifier for a website or a web page on the internet, also known as URL (Uniform Resource Locator).

Short-Term Memory

A component of memory where small amounts of information can be kept for a short period of time.

Q2: When unit sales are constant, but the

Q22: The Puyer Corporation makes and sells only

Q78: Beamish Incorporated, which produces a single product,

Q90: Smith Corporation makes and sells a single

Q100: Marcelin Corporation manufactures and sells one product.

Q181: Meli Corporation manufactures two products: Product L61P

Q242: Farris Corporation, which has only one product,

Q271: Addleman Corporation has an activity-based costing system

Q331: The Kamienski Cleaning Brigade Company provides housecleaning

Q360: Boiser Corporation is conducting a time-driven activity-based