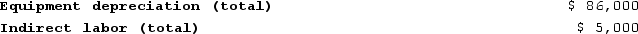

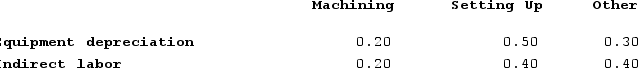

Howell Corporation's activity-based costing system has three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources.

Distribution of Resource Consumption Across Activity Cost Pools

Distribution of Resource Consumption Across Activity Cost Pools

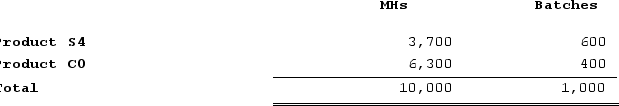

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products.

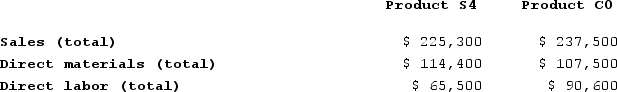

Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:

Required:a. Assign overhead costs to activity cost pools using activity-based costing.b. Calculate activity rates for each activity cost pool using activity-based costing.c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.d. Determine the product margins for each product using activity-based costing.

Required:a. Assign overhead costs to activity cost pools using activity-based costing.b. Calculate activity rates for each activity cost pool using activity-based costing.c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.d. Determine the product margins for each product using activity-based costing.

Definitions:

Wages Expense

Costs incurred by a company for the payment of hourly employee wages within a specific accounting period.

Accumulated Depreciation

The total depreciation for a fixed asset that has been charged to expense since that asset was acquired and made available for use.

Accrued Revenue

Revenue earned but not yet received in cash or recorded at the statement date, usually recognized in accrual basis accounting.

Snow Removal Services

Companies or departments dedicated to clearing snow and ice from outdoor surfaces, such as roads and walkways, to ensure safety and accessibility.

Q39: Dilly Farm Supply is located in a

Q80: Wyrich Corporation has two divisions: Blue Division

Q128: Davis Corporation is preparing its Manufacturing Overhead

Q134: In the second-stage allocation in activity-based costing,

Q139: Sarafiny Corporation is in the process of

Q142: Bryans Corporation has provided the following data

Q151: Scheuer Corporation uses activity-based costing to compute

Q262: Buckbee Corporation manufactures and sells one product.

Q307: Unit-level activities are performed each time a

Q314: Neelon Corporation has two divisions: Southern Division