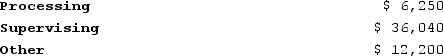

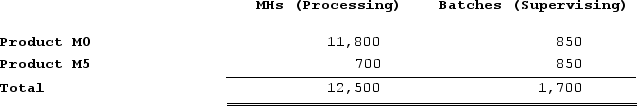

Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

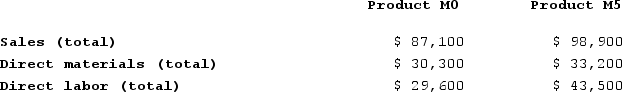

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. What is the overhead cost assigned to Product M5 under activity-based costing?

What is the overhead cost assigned to Product M5 under activity-based costing?

Definitions:

Parent Company

A parent company is a corporation that owns enough voting stock in another firm to control management and operations by influencing or electing its board of directors.

Subsidiary Company

A company that is completely or partly owned and wholly controlled by another company, referred to as the parent company.

Inventory

An accounting term for goods and materials held by a company in stock with the intention of selling them or transforming them in the production process.

Consolidated Cost

The combined cost of an asset that includes the purchase price and all costs necessary to prepare the asset for its intended use, within a group of consolidated companies.

Q58: The Charade Corporation is preparing its Manufacturing

Q104: The manufacturing overhead budget at Foshay Corporation

Q112: Petrini Corporation makes one product and it

Q149: Gauch Corporation is conducting a time-driven activity-based

Q187: Stefanovich Corporation makes one product. The company

Q215: Hadley Corporation, which has only one product,

Q226: Meester Corporation has an activity-based costing system

Q276: Heise Urban Diner is a charity supported

Q321: Kulka Corporation manufactures two products: Product F82D

Q373: Stapel Corporation is conducting a time-driven activity-based