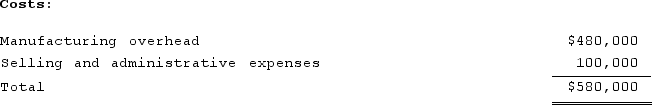

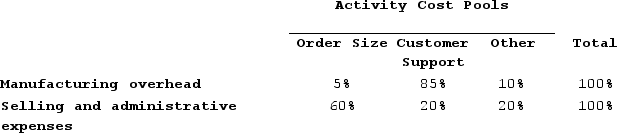

Diehl Corporation uses an activity-based costing system with three activity cost pools. The company has provided the following data concerning its costs and its activity based costing system:  Distribution of resource consumption:

Distribution of resource consumption: The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.You have been asked to complete the first-stage allocation of costs to the activity cost pools.How much cost, in total, would be allocated in the first-stage allocation to the Customer Support activity cost pool?

The "Other" activity cost pool consists of the costs of idle capacity and organization-sustaining costs.You have been asked to complete the first-stage allocation of costs to the activity cost pools.How much cost, in total, would be allocated in the first-stage allocation to the Customer Support activity cost pool?

Definitions:

Labor Rate Variance

The difference between the actual cost of labor and the expected (or budgeted) cost.

Actual Results

The real outcomes or results achieved and recorded after a particular period or activity, often compared against planned or forecasted results.

Standard Cost System

An accounting method that applies estimated costs to product units to predict production expenses and aid in budgeting.

Labor Rate Variance

The discrepancy between what labor actually costs and what was initially budgeted or considered as the standard labor cost.

Q75: Baraban Corporation has provided the following data

Q127: Elison Corporation, which has only one product,

Q141: Scholfield Enterprises makes a variety of products

Q172: Laizure Clinic uses patient-visits as its measure

Q226: Meester Corporation has an activity-based costing system

Q232: Bustillo Incorporated is working on its cash

Q256: Teel Printing uses two measures of activity,

Q260: Diehl Corporation uses an activity-based costing system

Q310: Jahnel Corporation is conducting a time-driven activity-based

Q320: The impact on net operating income of