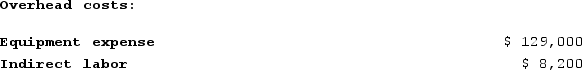

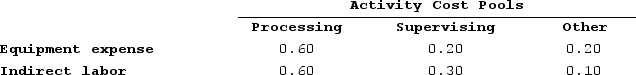

Deemer Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

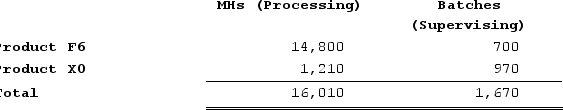

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

Definitions:

Eliminating Product

The process of discontinuing the production and sale of a product, typically due to poor sales, profitability, or strategic realignment.

Financial Advantage

The benefit gained from making a financially prudent decision that leads to wealth accumulation, cost savings, or any other monetary gain.

Dropping Product

The decision to discontinue the production and sale of a product line or item, typically due to it not meeting financial or strategic goals.

Contribution Margin

The amount remaining from sales revenues after all variable expenses are paid, contributing towards covering fixed costs and profit.

Q63: Weller Industrial Gas Corporation supplies acetylene and

Q136: When preparing a direct materials budget, beginning

Q137: Super-variable costing is a costing method that

Q146: Bries Corporation is preparing its cash budget

Q149: Gauch Corporation is conducting a time-driven activity-based

Q226: Meester Corporation has an activity-based costing system

Q226: Seventy percent of Pitkin Corporation's sales are

Q268: There are various budgets within the master

Q318: Davison Corporation, which has only one product,

Q328: Bryans Corporation has provided the following data