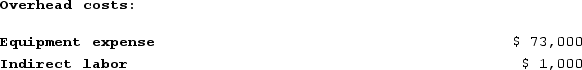

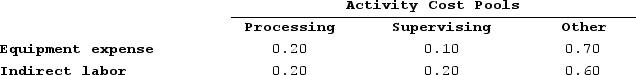

Addleman Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

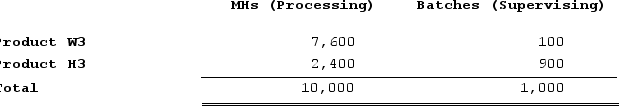

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

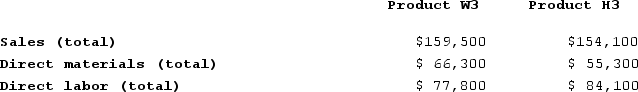

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data:

Finally, the costs of Processing and Supervising are combined with the following sales and direct cost data to determine product margins.Sales and Direct Cost Data: How much overhead cost is allocated to the Supervising activity cost pool under activity-based costing?

How much overhead cost is allocated to the Supervising activity cost pool under activity-based costing?

Definitions:

Patent Amortization

The process of gradually writing off the initial cost of a patent over its useful life, reflecting the decrease in value due to time and use.

Credit

The right side of an account.

Accumulated Amortization

The cumulative amount of amortization expense that has been recorded against an intangible asset.

Depletion

The allocation of the cost of a natural resource to expense in a rational and systematic manner over the resource’s useful life.

Q35: An activity-based costing system that is designed

Q46: Data concerning three of Kilmon Corporation's activity

Q70: Dilly Farm Supply is located in a

Q90: Neef Corporation has provided the following data

Q148: Riedell Corporation is conducting a time-driven activity-based

Q160: Petrini Corporation makes one product and it

Q177: Bennette Corporation has provided the following data

Q219: Reck Corporation uses activity-based costing to assign

Q306: Garrell Corporation is conducting a time-driven activity-based

Q327: Younan Corporation manufactures two products: Product E47F