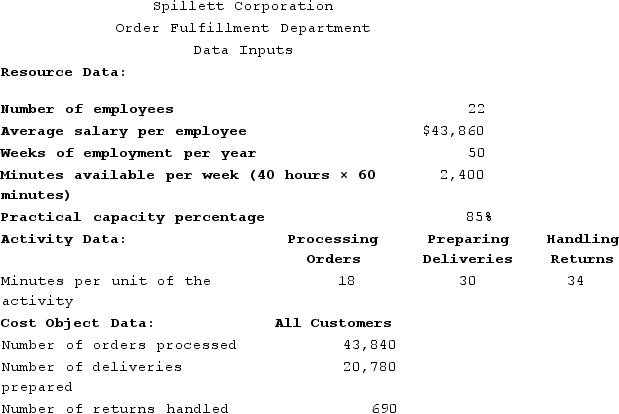

Spillett Corporation is conducting a time-driven activity-based costing study in its Order Fulfillment Department. The company has provided the following data to aid in that study:  On the Capacity Analysis report in time-driven activity-based costing, the "impact on expenses of matching capacity with demand" would be closest to:

On the Capacity Analysis report in time-driven activity-based costing, the "impact on expenses of matching capacity with demand" would be closest to:

Definitions:

Quick Ratio

A liquidity metric that indicates a company's ability to cover its current liabilities without selling inventory, calculated as (cash plus marketable securities plus accounts receivable) divided by current liabilities.

Temporary Investments

Short-term investments that a company plans to convert into cash within a short period, typically one year or less.

Remote Contingent Liability

A potential financial obligation that is considered to be unlikely to occur; it is noted in financial statements as a footnote to provide full disclosure.

Accrual

A method of accounting that recognizes revenue and expenses when they are incurred, regardless of when cash transactions occur.

Q16: Deemer Corporation has an activity-based costing system

Q121: Meade Nuptial Bakery makes very elaborate wedding

Q146: Krepps Corporation produces a single product. Last

Q156: Krepps Corporation produces a single product. Last

Q212: Michard Corporation makes one product and it

Q219: Buckbee Corporation manufactures and sells one product.

Q227: Nissley Wedding Fantasy Corporation makes very elaborate

Q268: Doede Corporation uses activity-based costing to compute

Q286: Tustin Corporation has provided the following data

Q318: Davison Corporation, which has only one product,