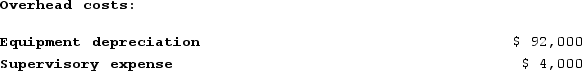

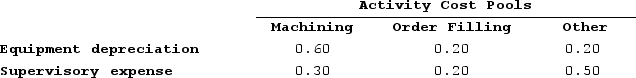

Doede Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment depreciation and supervisory expense--to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

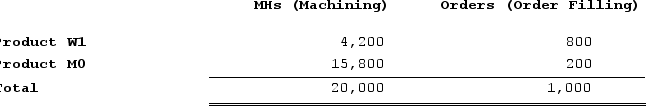

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity:

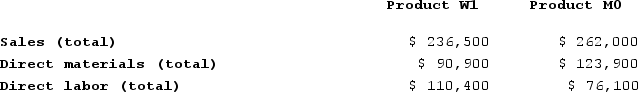

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products.Activity: Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Machining and Order Filling costs to determine product margins.Sales and Direct Cost Data: What is the overhead cost assigned to Product W1 under activity-based costing?

What is the overhead cost assigned to Product W1 under activity-based costing?

Definitions:

Equilibrium Market Wage

The wage rate at which the quantity of labor supplied equals the quantity of labor demanded in a given market.

Bricklayers

Skilled tradespeople who lay bricks to construct brickwork for buildings and other structures.

Marginal Product

The additional output resulting from the use of one more unit of a productive resource.

Market Wage Rate

The prevailing rate of pay offered for a certain job in the labor market, which can vary based on location, industry, and job requirements.

Q20: Flemming Corporation uses activity-based costing to compute

Q49: Smith Corporation makes and sells a single

Q62: Activity rates from Lippard Corporation's activity-based costing

Q79: Bramble Corporation is a small wholesaler of

Q81: Adamyan Urban Diner is a charity supported

Q185: Marst Corporation's budgeted production in units and

Q192: Musich Corporation has an activity-based costing system

Q244: Kray Incorporated, which produces a single product,

Q267: Beach Corporation, which produces a single product,

Q301: Janos Corporation, which has only one product,