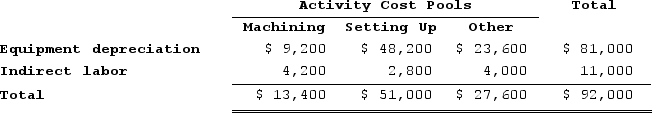

Musich Corporation has an activity-based costing system with three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, have been allocated to the cost pools already and are provided in the table below.

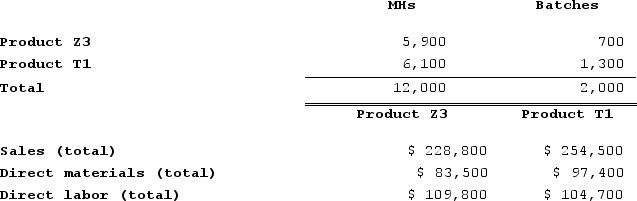

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:a. Calculate activity rates for each activity cost pool using activity-based costing. b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. c. Determine the product margins for each product using activity-based costing.

Required:a. Calculate activity rates for each activity cost pool using activity-based costing. b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. c. Determine the product margins for each product using activity-based costing.

Definitions:

Acute Signs

immediate or early symptoms that indicate the onset of a condition or disease, often requiring prompt attention.

Emotional Distress

Refers to a state of emotional suffering typically characterized by feelings of anxiety, depression, and a general sense of being overwhelmed.

Milgram's Study

An influential research project led by Stanley Milgram which showed that people are likely to follow orders from an authority figure, even to the extent of causing harm to others.

Group Size

The number of individuals forming a social or functional cluster, influencing the group's dynamics, interactions, and effectiveness.

Q43: Michard Corporation makes one product and it

Q56: Under super-variable costing, which of the following

Q92: Ieso Corporation has two stores: J and

Q165: Groleau Corporation has an activity-based costing system

Q179: Labadie Corporation manufactures and sells one product.

Q246: Zable Corporation has two divisions: Town Division

Q297: McCoy Corporation manufactures a computer monitor. Shown

Q312: The controller of Hendershot Corporation estimates the

Q329: Wedd Corporation uses activity-based costing to assign

Q351: Departmental overhead rates may not correctly assign