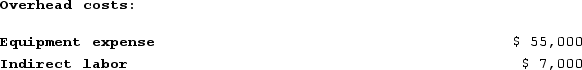

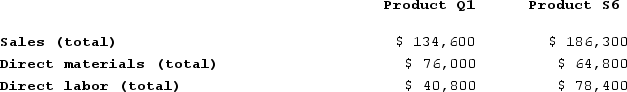

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

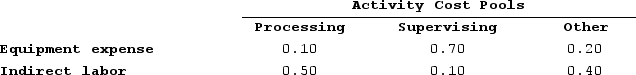

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

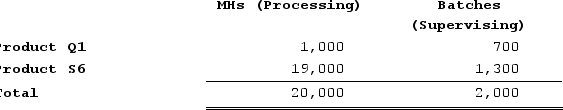

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data: The activity rate for the Processing activity cost pool under activity-based costing is closest to:

The activity rate for the Processing activity cost pool under activity-based costing is closest to:

Definitions:

Employer Initiative

Actions initiated by employers to improve workplace conditions, productivity, or relations with employees, often including innovative practices and policies.

Favorable Settlement

An agreement reached through negotiation or mediation that is considered advantageous or satisfactory to all involved parties.

Pressure Tactic

A strategy or method applied to influence or persuade others to meet certain demands, often used in negotiations or protests.

Lowered Productivity

A reduction in the rate at which employees produce goods or services, often indicating inefficiencies or challenges within the workplace.

Q44: The manufacturing overhead budget of Reigle Corporation

Q49: Smith Corporation makes and sells a single

Q118: Hails Corporation manufactures two products: Product Q21F

Q145: Jahnel Corporation is conducting a time-driven activity-based

Q153: Dilly Farm Supply is located in a

Q168: The manufacturing overhead budget lists all costs

Q246: The budgeted income statement is typically prepared

Q265: Coles Corporation, Incorporated makes and sells a

Q273: Sevenbergen Corporation makes one product and has

Q276: A company produces a single product. Variable