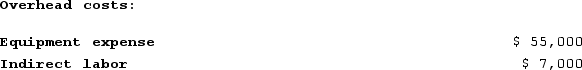

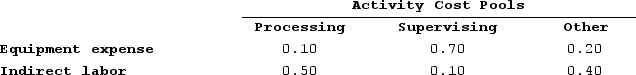

Scheuer Corporation uses activity-based costing to compute product margins. In the first stage, the activity-based costing system allocates two overhead accounts--equipment expense and indirect labor--to three activity cost pools--Processing, Supervising, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

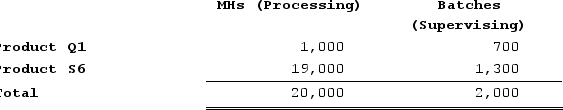

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

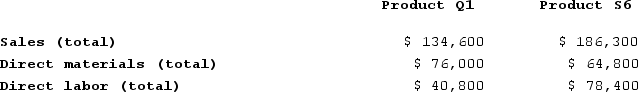

In the second stage, Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data:

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.Sales and Direct Cost Data: What is the overhead cost assigned to Product Q1 under activity-based costing?

What is the overhead cost assigned to Product Q1 under activity-based costing?

Definitions:

Market Price

The present cost at which a product or service is available for purchase or sale in a specific market.

Optimal Short-Run Output

The level of production that maximizes profit or minimizes loss in the short term.

Market Price

The current price at which an asset or service can be bought or sold, determined by the supply and demand dynamics in the market.

Downward-Sloping Demand Curves

A graphical representation indicating that as the price of a good or service decreases, the quantity demanded increases, and vice versa.

Q21: Paradise Corporation budgets on an annual basis

Q38: Deemer Corporation has an activity-based costing system

Q56: Roberts Enterprises has budgeted sales in units

Q91: Sioux Corporation is estimating the following sales

Q109: Aaron Corporation, which has only one product,

Q139: Wolanski Corporation has provided the following data

Q145: The manufacturing overhead budget at Polich Corporation

Q162: Plummer Corporation has provided the following data

Q353: Diehl Corporation uses an activity-based costing system

Q383: Gabuat Corporation, which has only one product,