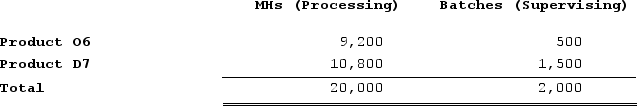

Wedd Corporation uses activity-based costing to assign overhead costs to products. Overhead costs have already been allocated to the company's three activity cost pools as follows: Processing, $27,200; Supervising, $9,300; and Other, $9,500. Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:  What is the overhead cost assigned to Product O6 under activity-based costing?

What is the overhead cost assigned to Product O6 under activity-based costing?

Definitions:

Bankruptcy

A legal process by which individuals or entities who cannot repay debts to creditors may seek relief from some or all of their debts.

Discharge

The termination of an obligation, such as a contractual duty or a financial debt, usually upon the completion of the terms agreed upon.

Preprinted Promissory Note

A written, standardized promise to pay a specified amount of money on demand or at a defined time, with predefined terms.

Due Date

The specified day by which an obligation must be fulfilled or a task completed.

Q6: The Bandeiras Corporation, a merchandising firm, has

Q68: Weller Industrial Gas Corporation supplies acetylene and

Q81: Luchini Corporation makes one product and it

Q109: Aaron Corporation, which has only one product,

Q188: Aaron Corporation, which has only one product,

Q205: Petrini Corporation makes one product and it

Q229: All differences between super-variable costing and variable

Q300: Lopresto Corporation is conducting a time-driven activity-based

Q306: A manufacturing company that produces a single

Q322: Leaper Corporation uses an activity-based costing system