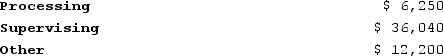

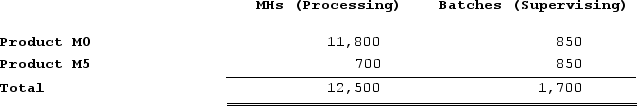

Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

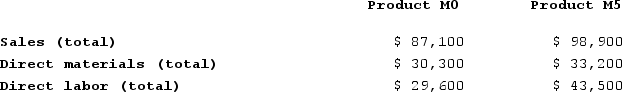

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. What is the overhead cost assigned to Product M5 under activity-based costing?

What is the overhead cost assigned to Product M5 under activity-based costing?

Definitions:

Partially Assembled

Refers to products or goods that have been partially put together but require additional assembly or work to be considered complete.

Raw Logs

Unprocessed timber that has been cut but not yet transformed into lumber or other finished products.

Least Liquid

Assets that are hardest to convert into cash without significant loss in value.

Credit Period

The duration of time the buyer is allowed to pay for a purchase after the sale has been made, without incurring any interest.

Q9: Stut Corporation, a retailer, plans to sell

Q18: One of the weaknesses of budgets is

Q34: Tustin Corporation has provided the following data

Q114: Depasquale Corporation is working on its direct

Q127: Elison Corporation, which has only one product,

Q153: Dilly Farm Supply is located in a

Q159: Haylock Incorporated bases its manufacturing overhead budget

Q176: The disbursements section of a cash budget

Q331: Gabuat Corporation, which has only one product,

Q348: Handal Corporation uses activity-based costing to compute