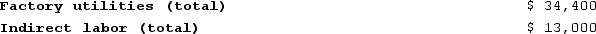

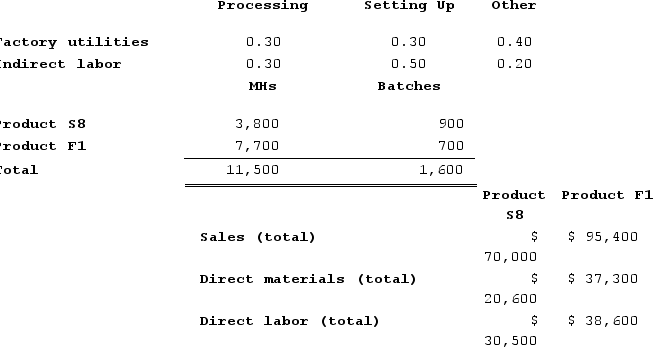

Groleau Corporation has an activity-based costing system with three activity cost pools--Processing, Setting Up, and Other. The company's overhead costs, which consist of factory utilities and indirect labor, are allocated to the cost pools in proportion to the activity cost pools' consumption of resources. Costs in the Processing cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs and activity-based costing system appear below:

Distribution of Resource Consumption Across Activity Cost Pools

Distribution of Resource Consumption Across Activity Cost Pools

Required:a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing.

Required:a. Assign overhead costs to activity cost pools using activity-based costing. b. Calculate activity rates for each activity cost pool using activity-based costing. c. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. d. Determine the product margins for each product using activity-based costing.

Definitions:

Vertical Differentiation

The structuring of an organization into levels of hierarchy, often to distinguish between varying degrees of authority and responsibility.

Empowerment

A process aimed at giving employees more autonomy, authority, and control over their work and decision-making to improve engagement and performance.

Supervision

The process of directing, monitoring, and overseeing the performance and productivity of employees in an organization.

Formalization

The extent to which rules, procedures, and standards are written and strictly adhered to in an organization.

Q1: Sevenbergen Corporation makes one product and has

Q6: Bachrodt Corporation uses activity-based costing to compute

Q23: Worrel Corporation manufactures a single product. The

Q58: Bellue Incorporated manufactures a single product. Variable

Q80: The first-stage allocation in an ABC system

Q133: Dobles Corporation has provided the following data

Q146: Krepps Corporation produces a single product. Last

Q200: Caspion Corporation makes and sells a product

Q279: Carriveau Corporation has two divisions: Consumer Division

Q330: Abel Corporation uses activity-based costing. The company