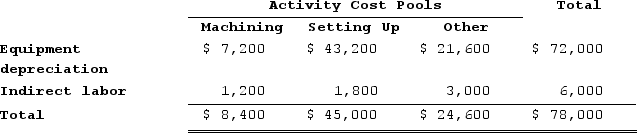

Musich Corporation has an activity-based costing system with three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs, which consist of equipment depreciation and indirect labor, have been allocated to the cost pools already and are provided in the table below.

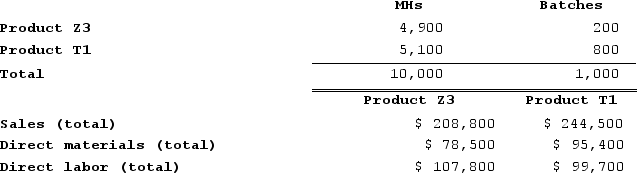

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. Data concerning the two products and the company's costs appear below:

Required:

Required:

a. Calculate activity rates for each activity cost pool using activity-based costing.b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing.c. Determine the product margins for each product using activity-based costing.

Definitions:

Opportunity Cost

Opportunity cost represents the value of the best alternative that is foregone when making a choice, highlighting the trade-offs involved in any decision.

Loads of Laundry

Quantity of laundry being washed and dried in a single operation or cycle.

Opportunity Cost

The cost of forgoing the next best alternative when a choice is made, representing the benefits one misses out on.

Comparative Advantage

The ability of an individual or entity to produce a good or service at a lower opportunity cost than others.

Q24: Pierceall Corporation is conducting a time-driven activity-based

Q98: Which of the following would not affect

Q135: Mccluer Corporation is conducting a time-driven activity-based

Q222: When reconciling variable costing and absorption costing

Q227: Dilly Farm Supply is located in a

Q259: Penders Corporation is conducting a time-driven activity-based

Q285: Bryans Corporation has provided the following data

Q286: Tustin Corporation has provided the following data

Q318: For a capital intensive, automated company the

Q378: Warrix Corporation has provided the following contribution