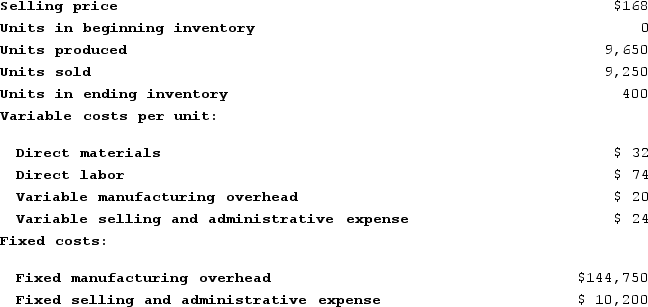

Farris Corporation, which has only one product, has provided the following data concerning its most recent month of operations:  What is the net operating income for the month under absorption costing?

What is the net operating income for the month under absorption costing?

Definitions:

Annual Amortization Expense

The portion of the cost of an intangible asset that is expensed through an organization's income statement each year over the asset's useful life.

Consolidated Tax Return

A tax return that combines the tax liability of all subsidiary companies with that of a parent company, treating them as one entity for tax purposes.

Domestic Subsidiaries

Subsidiaries located in the same country as the parent company, operating under the laws and regulations of that country.

Foreign Subsidiaries

Companies that are owned or controlled by another corporation (the parent company) and are located in a country different from where the parent company operates.

Q31: Thornbrough Corporation produces and sells a single

Q90: Weissman Corporation manufactures two products: Product E16S

Q94: For a given level of sales, a

Q98: Weimar Corporation is conducting a time-driven activity-based

Q117: Electrical costs at one of Finfrock Corporation's

Q138: Dercole Corporation uses activity-based costing to assign

Q318: For a capital intensive, automated company the

Q339: Orear Corporation manufactures two products: Product Z34D

Q371: Desilets Corporation has provided the following data

Q374: Hadley Corporation, which has only one product,