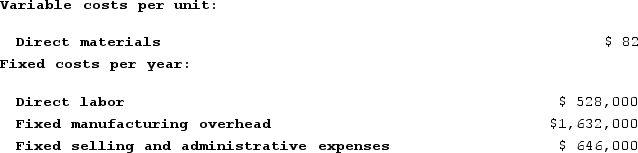

Union Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 24,000 units and sold 17,000 units. The company's only product is sold for $232 per unit.Assume that the company uses an absorption costing system that assigns $22 of direct labor cost and $68 of fixed manufacturing overhead to each unit that is produced. The net operating income under this costing system is:

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 24,000 units and sold 17,000 units. The company's only product is sold for $232 per unit.Assume that the company uses an absorption costing system that assigns $22 of direct labor cost and $68 of fixed manufacturing overhead to each unit that is produced. The net operating income under this costing system is:

Definitions:

Marginal Revenue

The incremental gain in revenue achieved by a company for selling an additional unit of product or service.

Marginal Cost

The additional cost incurred by producing one more unit of a good or service, a critical concept for economic analysis and decision-making.

Total Revenue

The total amount of money received by a company from the sale of its goods or services before any expenses are subtracted.

Total Variable Cost

The total expense that changes in proportion to changes in the volume of output or production.

Q2: When unit sales are constant, but the

Q72: Offerman Corporation is conducting a time-driven activity-based

Q76: Net operating income computed under variable costing

Q130: Callum Corporation is conducting a time-driven activity-based

Q138: Wolanski Corporation has provided the following data

Q148: A flour manufacturer is more likely to

Q151: Least-squares regression selects the values for the

Q184: Dallavalle Corporation manufactures and sells one product.

Q298: Hettrick International Corporation's only product sells for

Q324: Callander Corporation is a wholesaler that sells