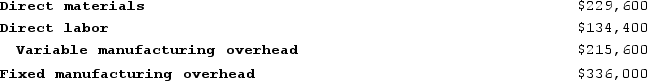

Krepps Corporation produces a single product. Last year, Krepps manufactured 28,000 units and sold 22,500 units. Production costs for the year were as follows:  Sales totaled $1,046,250 for the year, variable selling and administrative expenses totaled $117,000, and fixed selling and administrative expenses totaled $201,600. There was no beginning inventory. Assume that direct labor is a variable cost.Under variable costing, the company's net operating income for the year would be:

Sales totaled $1,046,250 for the year, variable selling and administrative expenses totaled $117,000, and fixed selling and administrative expenses totaled $201,600. There was no beginning inventory. Assume that direct labor is a variable cost.Under variable costing, the company's net operating income for the year would be:

Definitions:

Affective

Relating to moods, feelings, and attitudes; the emotional aspect of the mind's function.

Attitude

A settled way of thinking or feeling about someone or something, typically reflected in a person's behavior.

Physiological

Related to the normal functions of living organisms and their parts, including all physical and chemical processes.

Evolutionary

Pertaining to the process of natural selection and adaptation where species undergo genetic change over time, resulting in new characteristics that can enhance survival and reproduction.

Q39: Doles Corporation uses the following activity rates

Q54: A manufacturer of tiling grout has supplied

Q71: Spiess Corporation has two major business segments--Apparel

Q80: Warbler Gift's reported the following information for

Q95: Jerrel Corporation sells a product for $230

Q97: Moorman Corporation has an activity-based costing system

Q167: The Southern Corporation manufactures a single product

Q256: Tat Corporation produces a single product and

Q292: Brester Corporation is conducting a time-driven activity-based

Q303: Edal Corporation has provided the following production