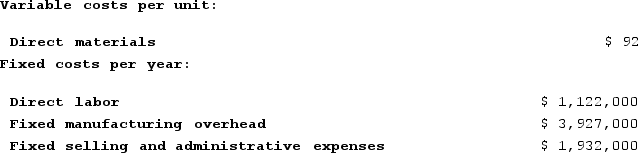

Marcelin Corporation manufactures and sells one product. The following information pertains to the company's first year of operations:  The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 51,000 units and sold 46,000 units. The company's only product is sold for $276 per unit.The company is considering using either super-variable costing or a variable costing system that assigns $22 of direct labor cost to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

The company does not have any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, the company produced 51,000 units and sold 46,000 units. The company's only product is sold for $276 per unit.The company is considering using either super-variable costing or a variable costing system that assigns $22 of direct labor cost to each unit that is produced. Which of the following statements is true regarding the net operating income in the first year?

Definitions:

Internal Rate of Return

A financial metric used to estimate the profitability of potential investments by calculating the rate of return at which the net present value of costs (cash outflows) equals the net present value of benefits (cash inflows).

Average Rate of Return

A financial ratio used to measure the profitability of an investment, calculated as the average annual profit divided by the initial investment cost.

Cash Payback Period

The time period required for the cash inflows from a capital investment project to cover the initial cash outlay.

Net Cash Inflow

The surplus of cash revenues over cash expenses in a given period, indicating the liquidity added to an entity.

Q6: Valdez Corporation has provided the following contribution

Q30: Compton Corporation is a wholesale distributor of

Q46: WV Construction has two divisions: Remodeling and

Q98: Caruso Incorporated, which produces a single product,

Q158: The order in which the costs of

Q169: Beckley Corporation has provided the following data

Q242: In both the direct and step-down methods

Q305: Helmers Corporation manufactures a single product. Variable

Q362: A quick look at a scattergraph of

Q376: Marcelin Corporation manufactures and sells one product.