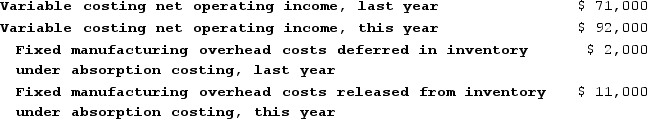

Worrel Corporation manufactures a single product. The following data pertain to the company's operations over the last two years:

Required:a. Determine the absorption costing net operating income last year.b. Determine the absorption costing net operating income this year.

Required:a. Determine the absorption costing net operating income last year.b. Determine the absorption costing net operating income this year.

Definitions:

Tax Purposes

Considerations related to the calculation and payment of taxes, influencing financial and business decisions.

Ethical Decisions

Choices made based on moral principles and values that aim to be right and fair in various situations.

Good Work

Work that is not only high in quality and beneficial to the employer but also fulfilling and morally commendable for the individual performing it.

Team Mates

Individuals who are part of the same group or team, working together towards a common goal.

Q15: Data concerning Strite Corporation's single product appear

Q20: Any difference in the equivalent units calculated

Q43: Data concerning Milian Corporation's single product appear

Q102: Sebree Corporation has provided the following contribution

Q111: The contribution margin ratio of Kuck Corporation's

Q207: Archie Corporation uses the following activity rates

Q235: In the cost reconciliation report under the

Q254: Labadie Corporation manufactures and sells one product.

Q290: Pierceall Corporation is conducting a time-driven activity-based

Q345: Bartucci Corporation is conducting a time-driven activity-based