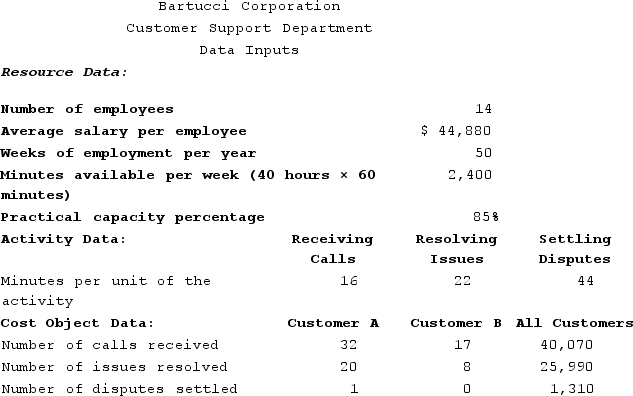

Bartucci Corporation is conducting a time-driven activity-based costing study in its Customer Support Department. The company has provided the following data to aid in that study:

Required:

Required:

a. Prepare a time-driven activity-based costing Customer Cost Analysis report that determines the total Customer Support Department cost assigned to each customer.

b. Prepare a time-driven activity-based costing Capacity Analysis report for the Customer Support Department that determines the impact on expenses of matching capacity with demand.

Definitions:

Marginal Tax Rates

The rate at which an individual or corporation's next dollar of taxable income is taxed.

Pre-Tax Loan Rate

The interest rate on a loan before taking into account any tax deductions that might apply.

Straight-Line Depreciation

A method of allocating the cost of a tangible asset over its useful life in equal annual installments.

Tax Loss Carryovers

Provisions that allow businesses or individuals to use their current losses to offset future profits or income for tax purposes, potentially reducing future tax liabilities.

Q40: Bryans Corporation has provided the following data

Q54: Dane Housecleaning provides housecleaning services to its

Q56: Imbesi Corporation is conducting a time-driven activity-based

Q96: Capes Corporation is a wholesaler of industrial

Q141: Scholfield Enterprises makes a variety of products

Q200: Corbett Corporation manufactures a single product. Last

Q302: Scheuer Corporation uses activity-based costing to compute

Q333: Handal Corporation uses activity-based costing to compute

Q372: Assuming the LIFO inventory flow assumption, when

Q383: Gabuat Corporation, which has only one product,